I recently completed a survey of over 100 small business owners asking them what their biggest struggle was when it comes to managing their business’s finances. The most common response was. “Alex, I don’t know if my business is cash flow positive or negative.”

So many business owners associate the success and subsequent financial health of their business with their bottom line or net income. You may be thinking, if I buy something or provide a service for $50 and sell it for $100, I should be good right?

While it is very important to know what your company’s net income is, knowing if your business is ending each period with a net positive cash inflow is just as if not more important than knowing your revenue figures.

Left unchecked, you could have a burning hole in your bank account and very quickly run out of cash one day and not even realize it until it’s too late.

Cash flow as you might have guessed, is a simple formula. Cash In – Cash Out = Cash leftover. The formula can be expanded to include 3 buckets; Cash From Operating Activities, Cash from Investing Activities, and Cash from Financing Activities. If you are using an accounting system like Xero, the accounting system will automatically separate these buckets for you and will prepare a statement of cash flows for you each month, so you can track where you are.

Most small businesses should only worry or focus most of their time on “Cash from Operating Activities” as this is where the bulk of your financial activity will occur. If you are not sure whether your business is cash flow positive or not, look at cash received from revenue and look at expenses like salaries, purchases, rent, and tax payments. This will help you get a rough idea but the best thing to do is to get yourself set up using a user-friendly accounting platform like Xero.

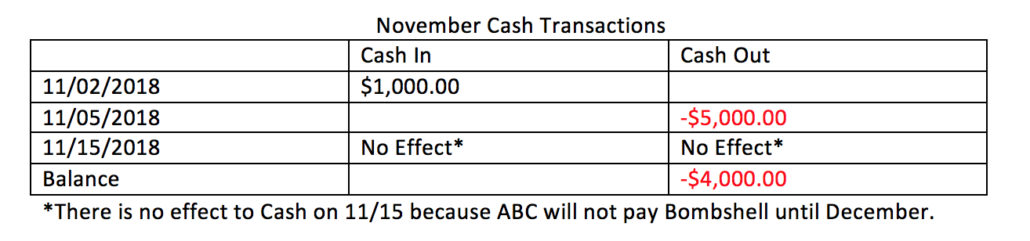

Let’s consider the following example to show you how to calculate cash flow for a business. Imagine you’re the owner of Bombshell, Inc. and the following transactions happened in November. Bombshell, Inc. is a leader in selling Gizmos.

For this example, we will assume Bombshell, Inc. uses the “Accrual” method for recording transactions. This method is widely used and accepted for businesses. In a separate blog post, we will cover the differences between “Accrual” and the “Cash” method of accounting.

11/02/2018 – Check received and Deposited for $1,000 from October Sale for 100 Gizmos

11/05/2018 – Purchase of 1000 Gizmos from ABC Supplier in Cash for $5,000

11/15/2018 – Sold 200 Gizmos for $2,000 from XYZ Corp. XYZ will pay in 30 days (12/15/2018)

The net cash movement for the Month of November was a decrease of $4,000.

Your revenue shows $3,000 (In Accrual Accounting, you record sales when they occur which isn’t always the same time when the cash moves) but your cash shows -$4,000. This example is seen everyday with many small business owners thinking that they have $3,000 (from Revenue) but in reality, they’re in the hole $4,000. If you had $100,000 in cash in the bank, this wouldn’t be much of a problem in this exercise. But if you’re living month-to-month on your sales and don’t keep your cash flow in check, you will be looking for other options to finance your business or using credit cards to float everything.

By taking a few minutes each month, you will be able to look at where you are to make sure you are bringing in more cash than taking out.

Questions? Find me in the Bombshell Business app!

About the Author

Alex Hubenthal

Bookscaping

Financial Acumen

Alex Hubenthal is the Owner of Bookscaping. His mission is to educate 100,000 small business owners in small business finance so they can not only thrive in their businesses but in their personal lives as well. Alex has helped his clients grow their revenue, found ways to help them reduce their tax bill, and has coached them on finding ways to standardize their business to add more to the bottom line.

Get Social: Facebook | Twitter | Instagram | LinkedIn